Getting The Stonewell Bookkeeping To Work

Wiki Article

Unknown Facts About Stonewell Bookkeeping

Table of ContentsThe smart Trick of Stonewell Bookkeeping That Nobody is Talking AboutThe 4-Minute Rule for Stonewell BookkeepingThe Buzz on Stonewell BookkeepingThe Main Principles Of Stonewell Bookkeeping Stonewell Bookkeeping - The Facts

Rather of going with a filing cupboard of different documents, invoices, and invoices, you can present comprehensive records to your accounting professional. After using your bookkeeping to file your taxes, the IRS might pick to do an audit.

That funding can can be found in the form of owner's equity, grants, company loans, and capitalists. Financiers require to have a good idea of your company before investing. If you don't have bookkeeping records, investors can not establish the success or failure of your firm. They require updated, exact info. And, that information requires to be easily available.

6 Simple Techniques For Stonewell Bookkeeping

This is not meant as lawful suggestions; to learn more, please go here..

We answered, "well, in order to understand just how much you need to be paying, we require to recognize exactly how much you're making. What is your web income? "Well, I have $179,000 in my account, so I presume my net earnings (revenues less expenses) is $18K".

Rumored Buzz on Stonewell Bookkeeping

While it can be that they have $18K in the account (and even that might not be real), your equilibrium in the financial institution does not always determine your revenue. If a person received a grant or a car loan, those funds are ruled out earnings. And they would not function into your income declaration in identifying your profits.

While it can be that they have $18K in the account (and even that might not be real), your equilibrium in the financial institution does not always determine your revenue. If a person received a grant or a car loan, those funds are ruled out earnings. And they would not function into your income declaration in identifying your profits.Many points that you believe are expenses and deductions are in reality neither. Accounting is the procedure of recording, identifying, and arranging a firm's monetary purchases and tax obligation filings.

An effective business requires assistance from professionals. With realistic objectives and a qualified bookkeeper, you can quickly resolve obstacles and keep those concerns at bay. We're below to aid. Leichter Accounting Providers is a skilled certified public accountant firm with a passion for bookkeeping and dedication to our clients - Accounting (https://site-ga3maigr2.godaddysites.com/f/why-bookkeeping-is-a-game-changer-for-your-business). We dedicate our energy to ensuring you have a solid monetary foundation for development.

Facts About Stonewell Bookkeeping Uncovered

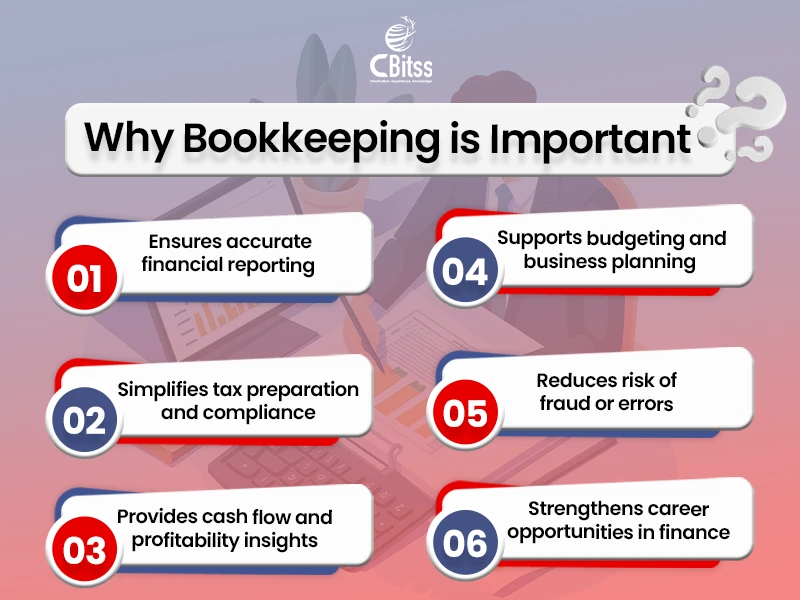

Accurate accounting is the foundation of good financial administration in any type of service. With good accounting, services can make much better choices due browse this site to the fact that clear monetary documents offer important data that can direct technique and enhance revenues.Accurate economic declarations build trust fund with lending institutions and financiers, increasing your opportunities of getting the capital you require to grow., organizations should routinely integrate their accounts.

An accountant will go across financial institution statements with internal records at the very least once a month to find errors or inconsistencies. Called bank settlement, this procedure ensures that the economic records of the business suit those of the bank.

They keep an eye on current payroll information, subtract taxes, and figure pay scales. Bookkeepers generate fundamental economic records, including: Profit and Loss Declarations Reveals income, expenses, and internet revenue. Balance Sheets Notes properties, liabilities, and equity. Capital Statements Tracks money movement in and out of the service (https://filesharingtalk.com/members/627904-hirestonewell). These records assist entrepreneur understand their monetary position and make educated choices.

The Buzz on Stonewell Bookkeeping

The most effective choice depends upon your budget plan and business requirements. Some little business proprietors like to take care of accounting themselves making use of software. While this is affordable, it can be lengthy and susceptible to errors. Tools like copyright, Xero, and FreshBooks permit company owner to automate accounting jobs. These programs assist with invoicing, financial institution settlement, and economic coverage.

Report this wiki page